The centralisation of Ethereum

In the past year, Ethereum's decentralization has been a topic of discussion, especially with its transition to Proof-of-Stake and the growth of rollups. In this article, we'll delve into the implications and potential dangers of this shift. Dive in to understand more.

Ethereum, since its inception, was lauded for its decentralization, primarily because it operated on a Proof-of-Work (PoW) consensus model, akin to Bitcoin. This model ensured that control wasn't too concentrated, fostering trust and security.

Ethereum's transition from Proof-of-Work to Proof-of-Stake has brought about significant changes. While PoS has reduced Ethereum's energy consumption by a whopping 99.99%, it has also centralized a large portion of ETH with specific entities.

As of July 2023 over 27 million ETH has been staked. However the vast majority has been staked with only a few entities like LidoFinance, Coinbase or Kraken. However it should be noted that Lido isn't a completely centralised entity.

This centralization becomes especially concerning when considering compliance. Some centralized validators and relayers haven't ruled out omitting transactions to comply with sanctions. Though the trend of censorship has been declining, we saw a spike in the last month.

While Lido holds a significant portion of the staked ETH, it's essential to note that they operate with multiple independent node operators. This setup somewhat mitigates centralization concerns, ensuring a more distributed control within the Lido ecosystem.

Ethereum's scaling journey has seen various proposed solutions. Initially, sharding, which involves splitting the blockchain into discrete pieces, was the anticipated method to scale Ethereum. However, the focus has since shifted towards Layer 2 rollups with proto-dank-sharding.

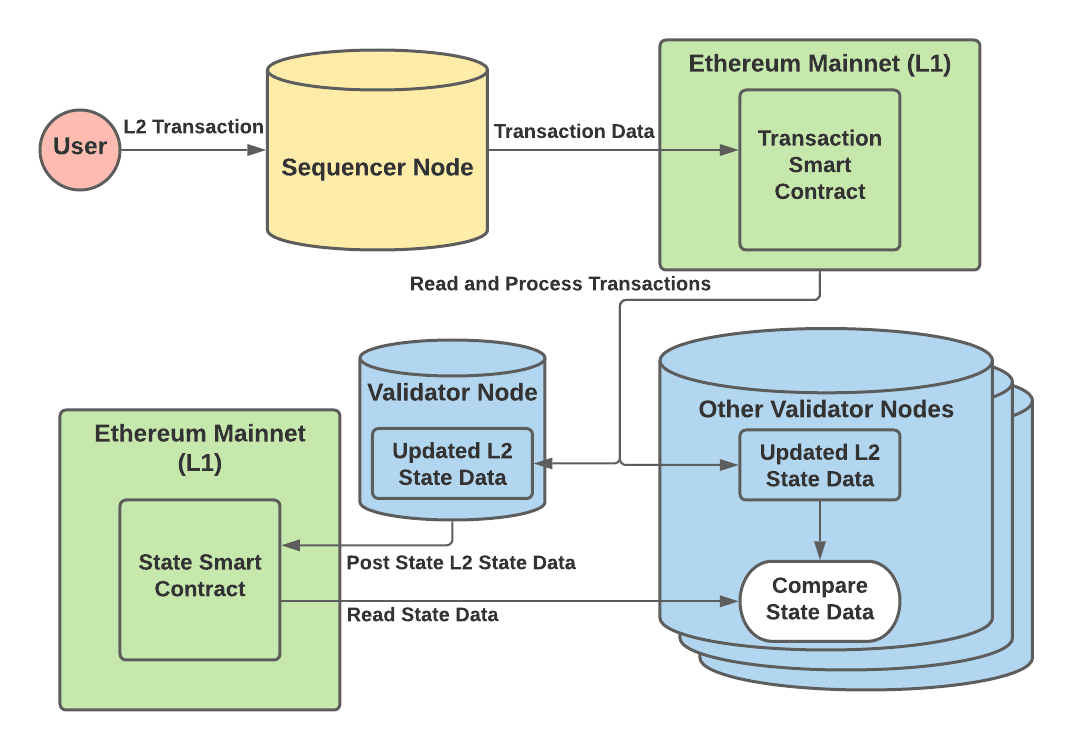

These rollups handle transactions off the main Ethereum network but still derive their security from it. Rollups execute transactions outside Layer 1, and the data is then posted to Layer 1 for consensus. There are two main types: Optimistic Rollups and Zero-Knowledge Rollups.

Rollups, while offering scalability benefits, come with major centralization concerns. A significant point of contention is the sequencer in rollups. Often, this sequencer is managed by a single entity, which then can again be subject to regulation and compliance.

Additionally asingle entity controlling the sequencer might have undue influence over transaction ordering, potentially leading to front-running or other manipulative practices. The Founder of Flashbots argues a cross-chain messaging can alleviate some of these risks.

In conclusion, while Ethereum's evolution offers promising scalability solutions, it's imperative to remain vigilant about potential centralization risks. As the ecosystem grows, maintaining the balance between efficiency and decentralization will be key to Ethereum's success.

This report may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. All material presented in this report, unless specifically indicated otherwise, is under copyright to 512m. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of 512m. The information, tools and material presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.