Analysing the new $MONEY stablecoin protocol.

The new stablecoin protocol defi.money is launching! Given our expertise in stablecoins and involvement in the broader Curve Finance ecosystem, we will be analysing this new platform in this article and tell you everything you need to know about $MONEY.

$MONEY is a USD-pegged stablecoin built on Optimism and Arbitrum and is based on @CurveFinance crvUSD architecture. Leveraging cross-chain capabilities and focusing on L2 scalability, it aims to provide a more capital-efficient, and interoperable stablecoin experience.

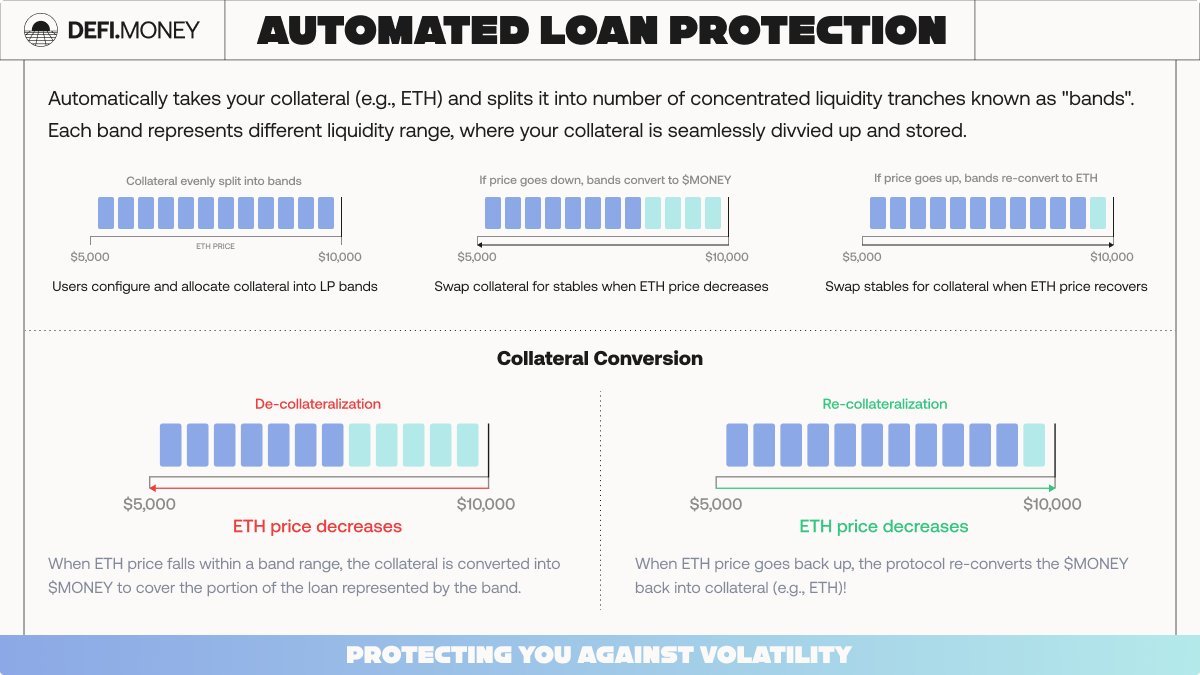

If you're not familiar with crvUSD's LLAMMA mechanism (renamed to Automated Loan Protection), it splits up collateral into bands, allowing for de- and re-collateralisation, higher LTV loans and smoother (softer) liquidations when compared to more traditional CDP protocols.

But $MONEY is more than a simple crvUSD fork, it also introduced a few advancements like:

Supporting broader collateral types

Improved UX for borrowing and leveraging

Enhanced LLAMMA mechanisms for greater stability

and more...

We are particularly excited about the built-in flashloans to allow for easier looping and leveraging as well as the integration of market hooks.Hooks allow for easier integration for 3rd party protocols, and for research companies like us to access market data for analytics.

Another feature we like is the inclusion of a Pro Mode, allowing more experienced traders to manually adjust the bands as well as see the market distribution. Whilst these features might be overwhelming for beginners, they are much appreciated for professionals like ourselves.

With defi.money being exclusive to L2s, we wanted to dive deeper into existing price data and analyse if their optimised LLAMA algorithm was able to deliver a smoother peg due to the reduced PegKeeper timeframe when compared to crvUSD on Ethereum Mainnet.

We analysed the price distribution of $MONEY since August 1st 2024 and compared it against $crvUSD in the boxplot below. As you can see, though $MONEY does not deviate too far off it's 1USD peg, it has been a lot more volatile than its counterpart.

However, this is not a fair comparison, considering crvUSD is a much more mature protocol, and the price data of $MONEY was collected during its guarded release. As TVL and usage grew, we saw the volatiliy drop significantly and expect it to be equal, if not below crvUSD's.

This reduction in peg volatility is even more apparent when looking at the price charts of both $MONEY and $crvUSD. This volatility trend will also continue to improve as the liquidity depth and amount of unique PegKeepers increases, which we believe will happen exponentially.

At launch $MONEY will be able to be minted with $wETH, $wBTC, $ARB and $wstETH, though we see more collateral options on the horizon soon. Research company LlamaRisk also already tested more exotic assets like $GMX, $OP, $PENDLE and $VELO amongst others.

It's also worthy to mention that @defidotmoney is backed by some of the biggest names in OG DeFi such as DCF God, Tetranode or Mr Block. As well as working closely with Michael Egorov, Mix Bytes and Chain Security to develop their protocol.

You can also see how $MONEY is being adopted live by checking out this amazing Dune dashboard that was built by Mr Block. As of writing, the TVL across Optimism and Arbitrum is 2.1 million USD, though we expect it to dramatically increase post-launch.

If you're interested in trying defi.money for yourself, we suggest doing it soon, as they also have a points system live, that reward open $MONEY loans, staking $MONEY as well as staking LP tokens.

This article may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. The information, tools and material presented in this article are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.