Banking without Banks: How InfiniFi's works On-Chain

Introduction

For centuries, the fractional reserve model has underpinned the global banking system. By lending out most customer deposits while keeping only a fraction in reserve, banks have been able to create credit, stimulate economic activity, and generate profits. But this model has often been a black box: depositors cannot immediately see how their money is deployed, what risks are taken, or how much liquidity is actually available at any point in time.

InfiniFi takes that familiar model and rebuilds it entirely on the blockchain. The aim is to keep the capital efficiency of fractional reserves, but make it transparent, programmable, and user-directed. It’s not just “banking without banks”, but an experiment in aligning depositor incentives, improving risk management, and solving the often overlooked duration gap problem.

From Fractional Reserves to Maturity Transformation

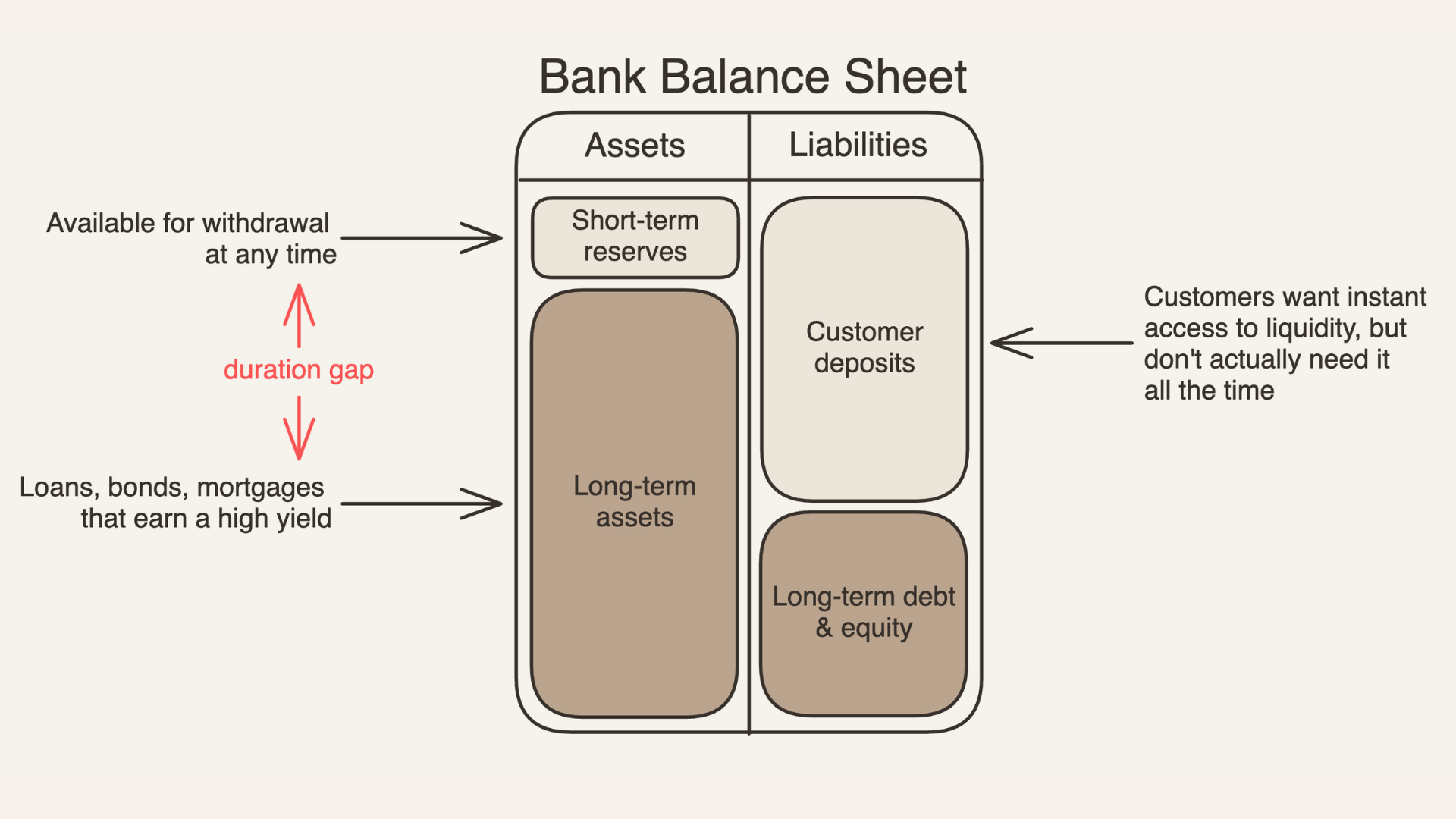

In traditional finance, fractional reserve banking is not just about keeping part of deposits liquid and lending the rest. It’s also about maturity transformation, meaning using short-term deposits to fund longer-term, higher-yielding assets.

When you deposit money into a bank, it might be available to you on demand, but the bank may have lent it out as a five-year loan or invested it in a 10-year bond. This is where the duration gap emerges: the mismatch between the maturity of liabilities (your deposit) and the assets they fund. This gap is the source of both higher returns and systemic risk. If too many depositors withdraw at once (aka a bank run), the bank may not be able to sell its long-term assets quickly enough without taking heavy losses.

TradFi banks manage this through statistical models, regulation, and government-backed insurance schemes. But these systems are often reactive and opaque. They rely on historical data, internal risk committees, and closed-door interventions.

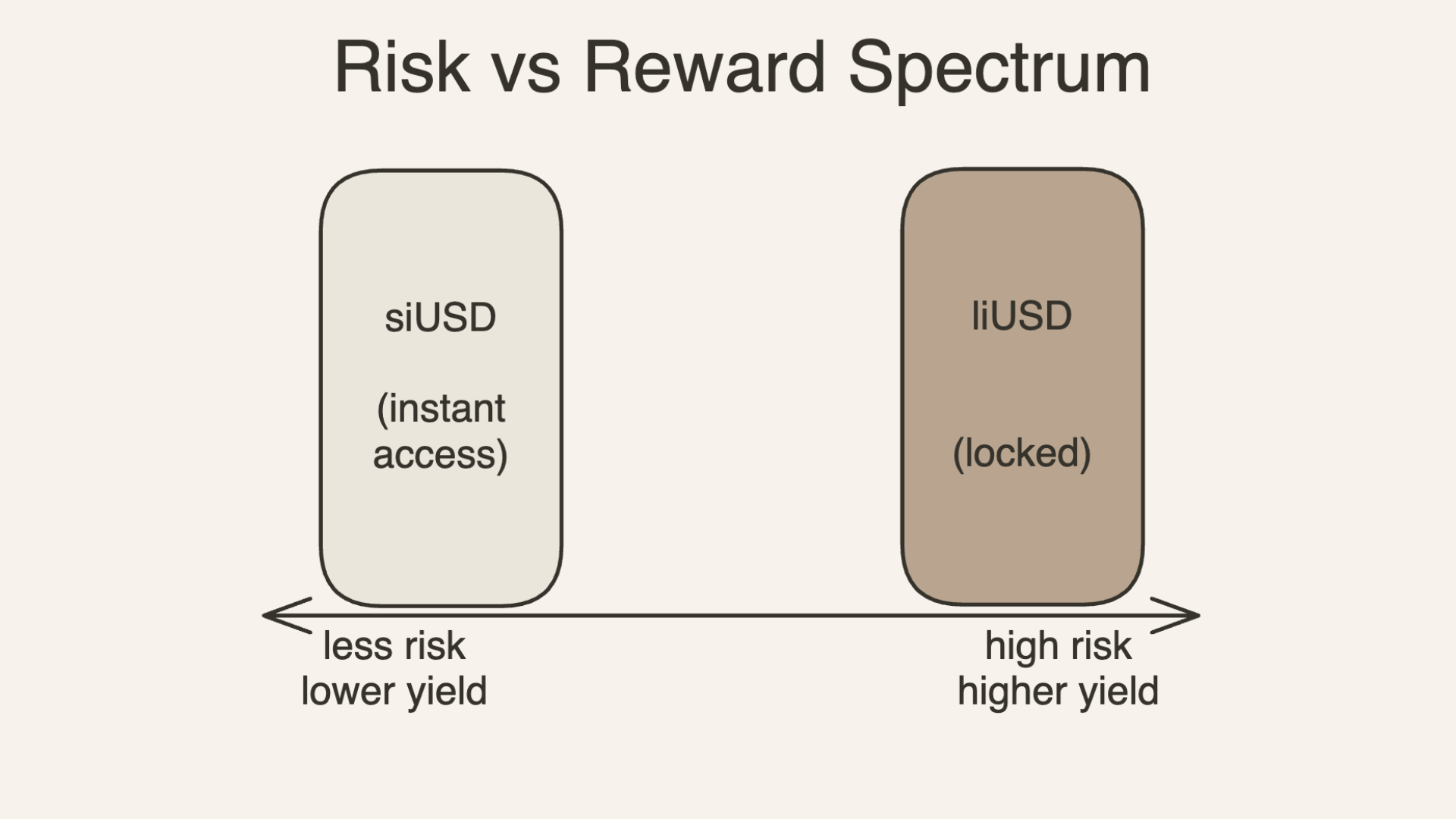

InfiniFi performs the same maturity transformation, but on-chain. Depositors can choose whether their funds are in the liquid pool (short-term, instant redemption, lower yield) or the locked pool (longer commitment, higher yield). The proportion of each determines how much capital can be deployed into longer-duration, higher-return strategies. The crucial difference is that in InfiniFi, all of this is visible to anyone in real time.

Risk, Reward, and Real-Time Visibility

InfiniFi’s design explicitly recognises that a significant portion of yield comes from taking maturity and liquidity risk, and that managing this risk well is key to stability.

Locked depositors commit to an unbonding period, signalling their willingness to accept reduced liquidity in exchange for higher returns. Liquid depositors keep the option to exit instantly, but still benefit from fractional co-deployment into longer-term strategies. This improves returns for both groups: a form of yield uplift enabled by fractional reserves, all whilst letting the protocol maintain a healthy liquidity buffer.

In traditional banks, depositors have no control over this allocation. In InfiniFi, they do. In fact, those locking the most for the longest periods also gain the greatest governance weight in deciding where capital is deployed. This aligns incentives: the people taking the most risk also have the most influence, and the greatest losses if things go wrong.

Risk Management by Design

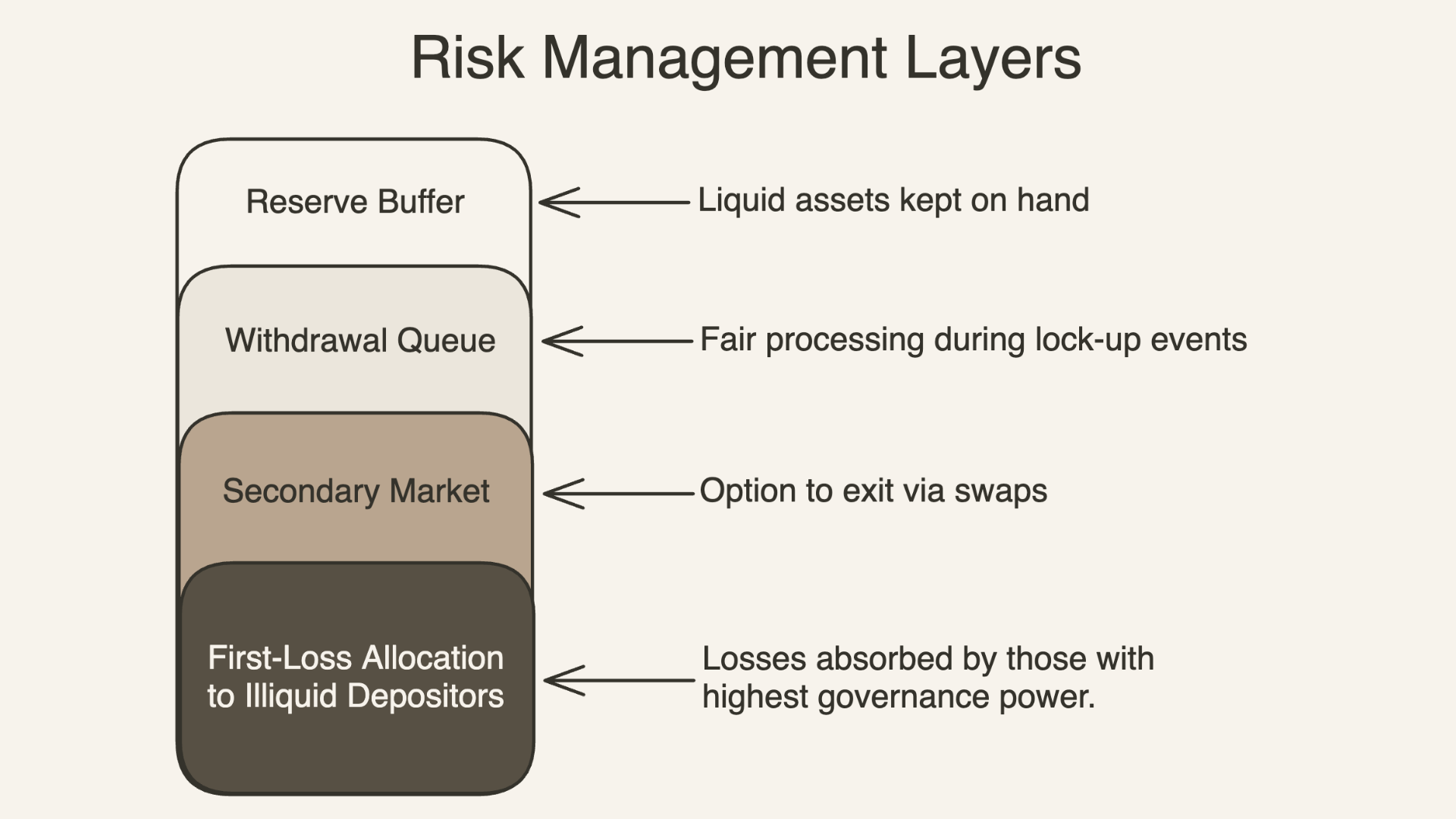

InfiniFi tackles the two big threats in any fractional reserve system: liquidity crises and asset defaults.

For liquidity risk, the reserve ratio is visible in real time on-chain, allowing users to judge safety for themselves. If liquid reserves are temporarily exhausted, withdrawals enter a fair first-in, first-out queue, preventing opportunistic bots from jumping the line. Secondary market liquidity (e.g., via Curve pools) gives depositors an exit option during these events, often at a temporary discount similar to how stETH traded before Ethereum withdrawals went live.

For credit and market risk, InfiniFi uses a first-loss principle: the most illiquid depositors, meaning those with the most influence over investment choices, absorb losses first. This disincentivises reckless risk-taking and encourages diversification across assets and protocols. Allocation caps also prevent over-concentration in any single strategy.

TradFi vs DeFi: Same Principles, Different Tools

Both systems rely on the fact that not all depositors withdraw at once. Both aim to invest part of their liabilities in longer-duration assets to earn a spread. The main differences are:

Transparency: InfiniFi’s reserves, allocations, and yields are public.

Depositor Choice: Users choose their own liquidity/return trade-off.

Governance Alignment: Risk-takers have more say but also more to lose.

Programmability: Rules are enforced automatically by smart contracts.

These changes don’t remove risk, but they make it visible and give depositors tools to manage it themselves, which is something no traditional bank offers.

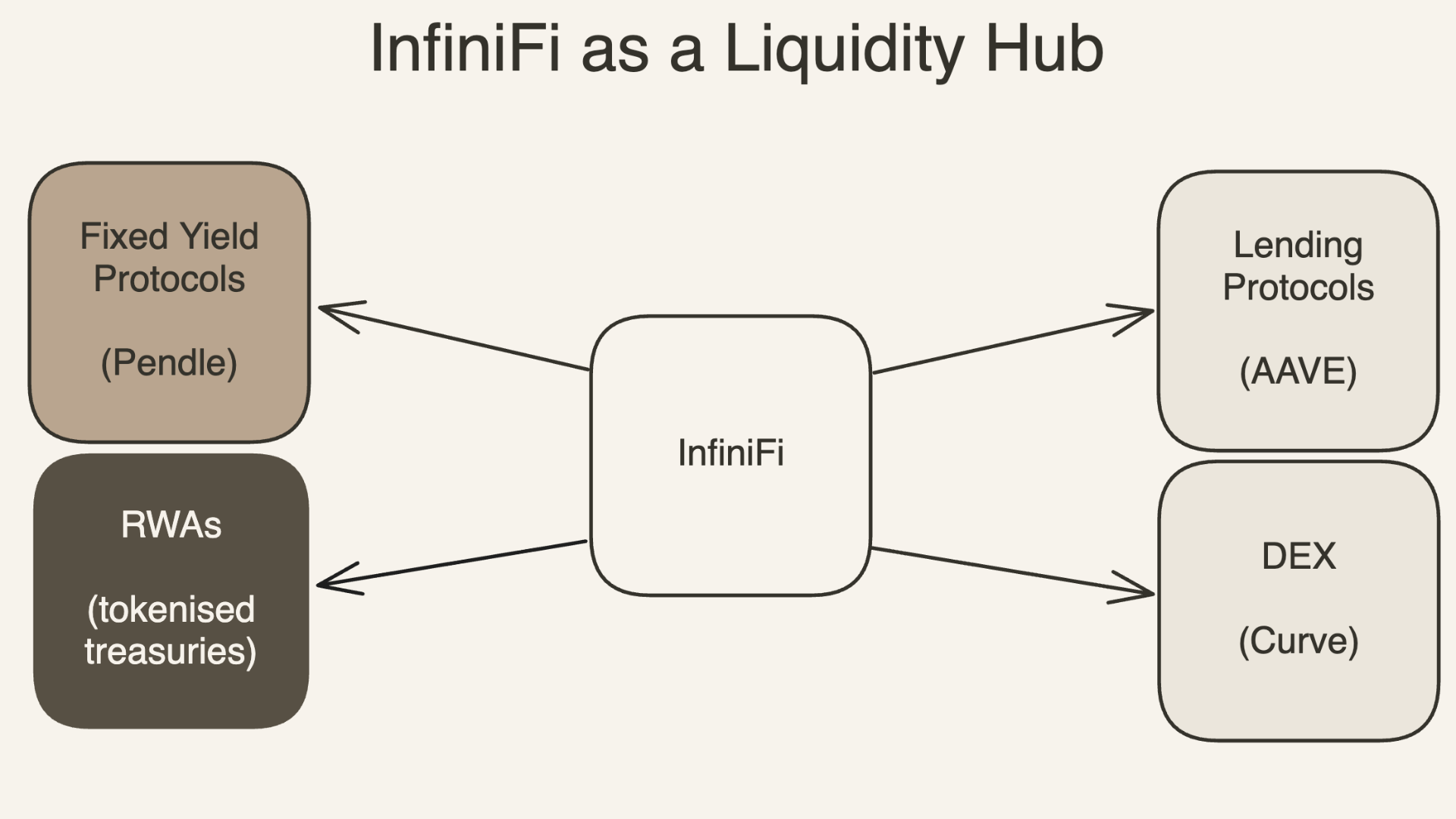

InfiniFi in the DeFi Ecosystem

InfiniFi is not trying to replace lending markets, DEXs, or RWA platforms. In fact, it can enhance them:

Lending protocols like Aave can receive more liquidity via InfiniFi’s liquid allocations.

Less liquid yield platforms like Pendle can onboard their fixed-term assets into InfiniFi, increasing returns for both their users and InfiniFi depositors.

Tokenised RWA platforms can gain a deeper liquidity pool for their products.

This symbiotic approach allows InfiniFi to boost yields without draining TVL from other protocols — in many cases, it increases it.

Analysing Early Data

InfiniFi’s growth trajectory since late May has been strong and consistent, with TVL climbing from zero to just over $65 million in under three months. The sharpest expansions occurred in early June and mid-July, after it launched its points program.

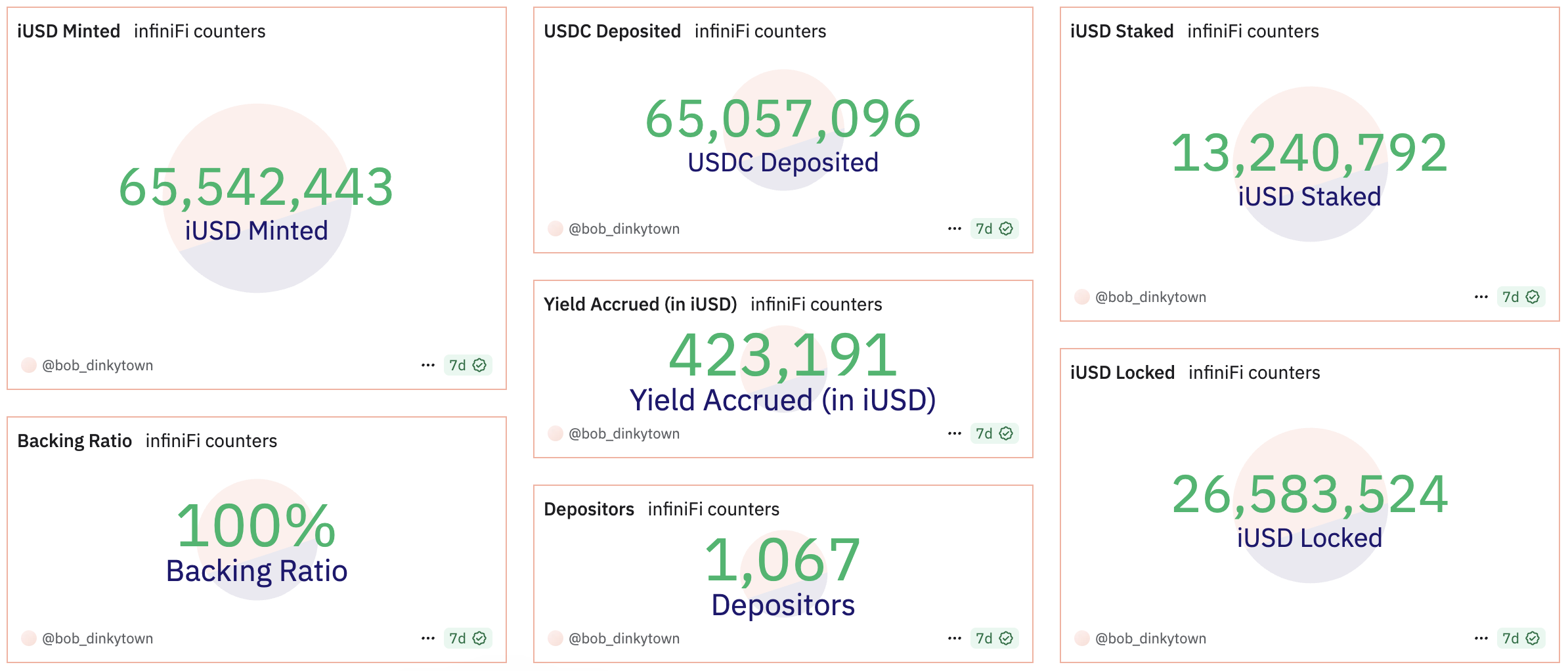

As of the latest data, 65.5 million iUSD have been minted, backed 1:1 by 65.1 million USDC deposits, resulting in a full 100% backing ratio. The platform currently counts 1,067 depositors, with 13.2 million iUSD staked and a further 26.6 million iUSD locked, indicating strong user commitment beyond simple minting. Yield accrual stands at 423,191 iUSD, suggesting that the protocol is already generating measurable returns for participants.

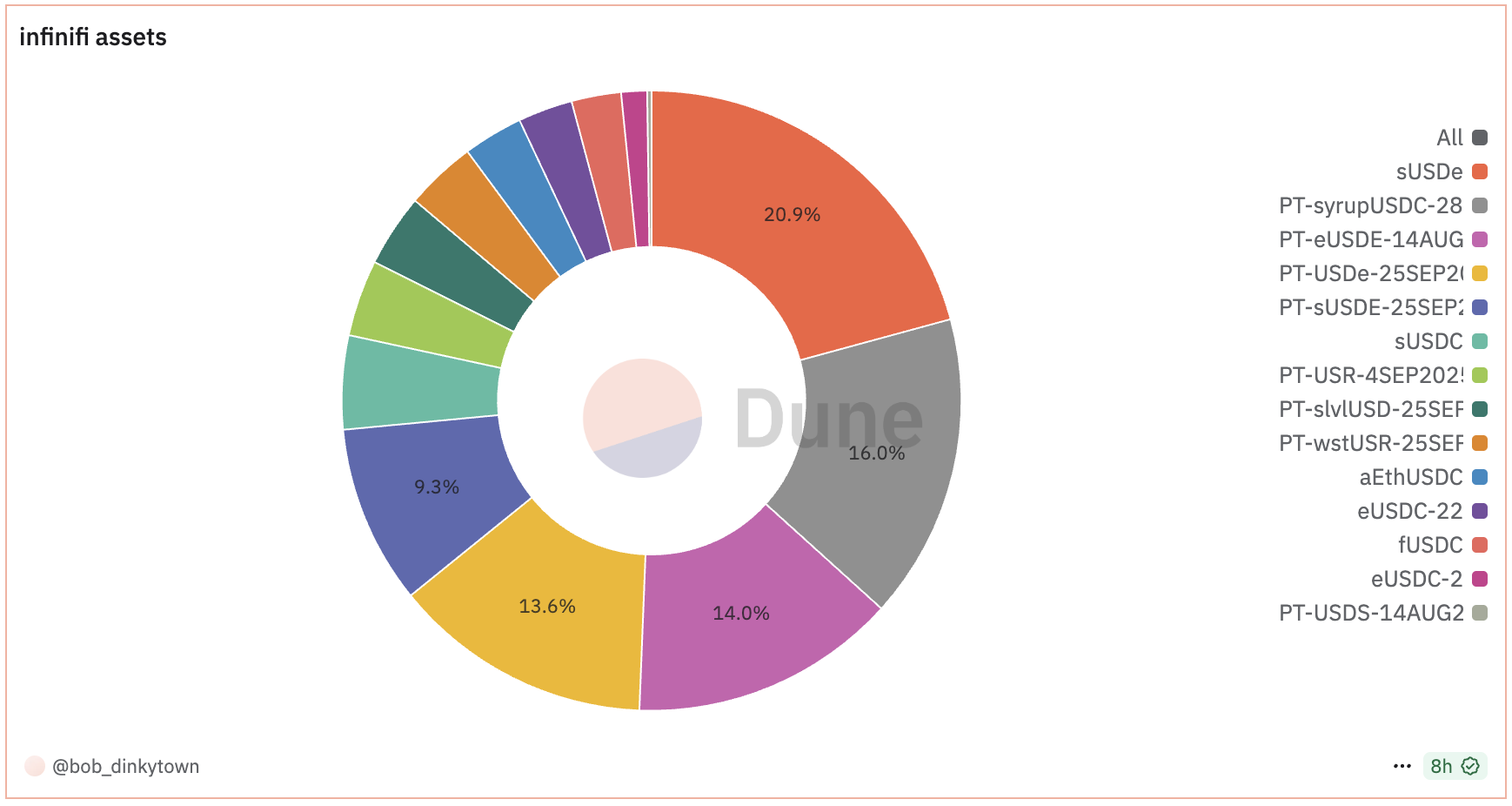

Asset composition shows diversification, with no single asset dominating the reserves. The largest allocation is to sUSDe (20.9%), followed by PT-syrupUSDC-20 (16.0%) and PT-eUSDe-14AUG (14.0%), alongside multiple other Pendle PT positions and stablecoin variants. This diversified allocation signals a deliberate strategy to balance yield opportunities with risk exposure.

Conclusion

InfiniFi’s early results show rapid adoption, with TVL exceeding $65 million in a few months, fully collateralised iUSD, and a diversified reserve spanning Pendle PTs and yield-bearing stablecoins. The model applies maturity transformation, turning short-term deposits into longer-term yield, and reinvests these returns into a stablecoin system that rewards staking and locking.

The benefits are clear: a 100% backing ratio, a broad collateral mix that limits single-asset risk, and integration with Pendle to offer additional yield strategies. Strong participation from over 1,067 depositors, many actively staking or using Pendle, signals growing user confidence.

Risks remain. Yields depend on the continued performance of underlying strategies, all subject to smart contract, liquidity, and market risk. Heavy reliance on Pendle and tokenised yield products may expose the system to interest rate shifts or market stress. Rapid growth could also test liquidity and risk management.

If InfiniFi sustains its current balance of growth and prudent asset allocation while maintaining full backing and navigating market volatility, it could establish itself as a leading player in DeFi’s fixed-income and stablecoin sectors. The early momentum is promising, but long-term success will depend on delivering stable yields without weakening collateral security.

This article may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. The information, tools and material presented in this article are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.