EulerEarn: passive yield, professionally curated

Introduction

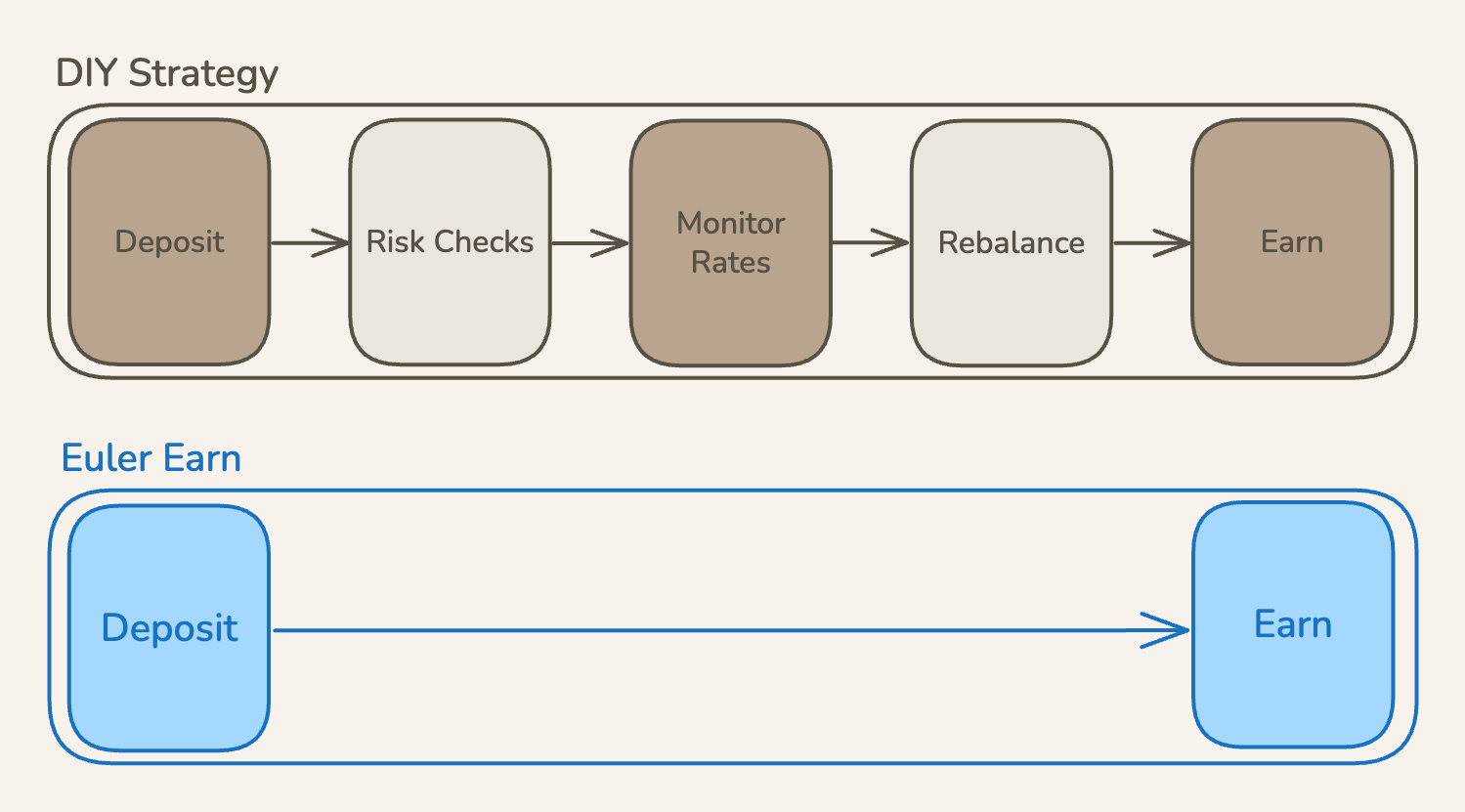

Nowadays, DeFi offers numerous sources of yield, but stitching them together into a coherent, well-managed portfolio is a challenging task for everyday users. It requires monitoring rates, moving capital between strategies, sizing exposures, and keeping enough liquidity for withdrawals.

EulerEarn addresses this problem with a simple promise: deposit a single asset into a non-custodial vault and let a professional curator allocate across a set of vetted ERC-4626 strategies, while all activity remains visible on-chain. In short, users obtain set-and-forget exposure, while specialists handle rebalancing and risk management within an immutable framework.

What is EulerEarn?

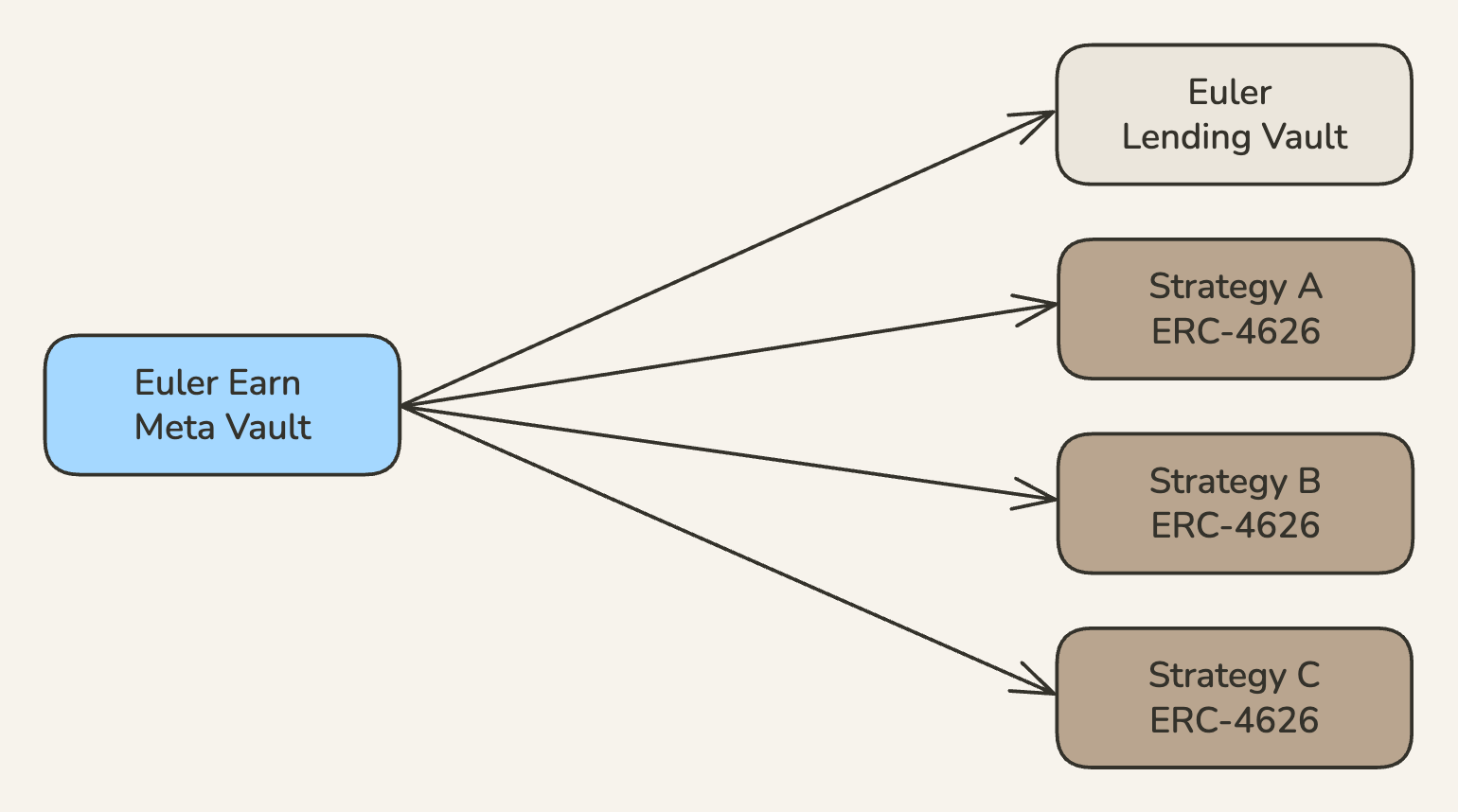

EulerEarn is a fork of MetaMorpho presented as a non-custodial, ERC-4626 “meta-vault.” Each vault accepts one underlying asset (for example, USDC or WETH). Deposits are pooled and then allocated across multiple ERC-4626 strategies, often Euler lending vaults, but any ERC-4626-compliant strategy can be whitelisted.

So a single deposit can participate in diversified yield sources without manual rotation. The user receives vault shares; their position’s value changes as the share price moves with realised strategy performance.

How does it work?

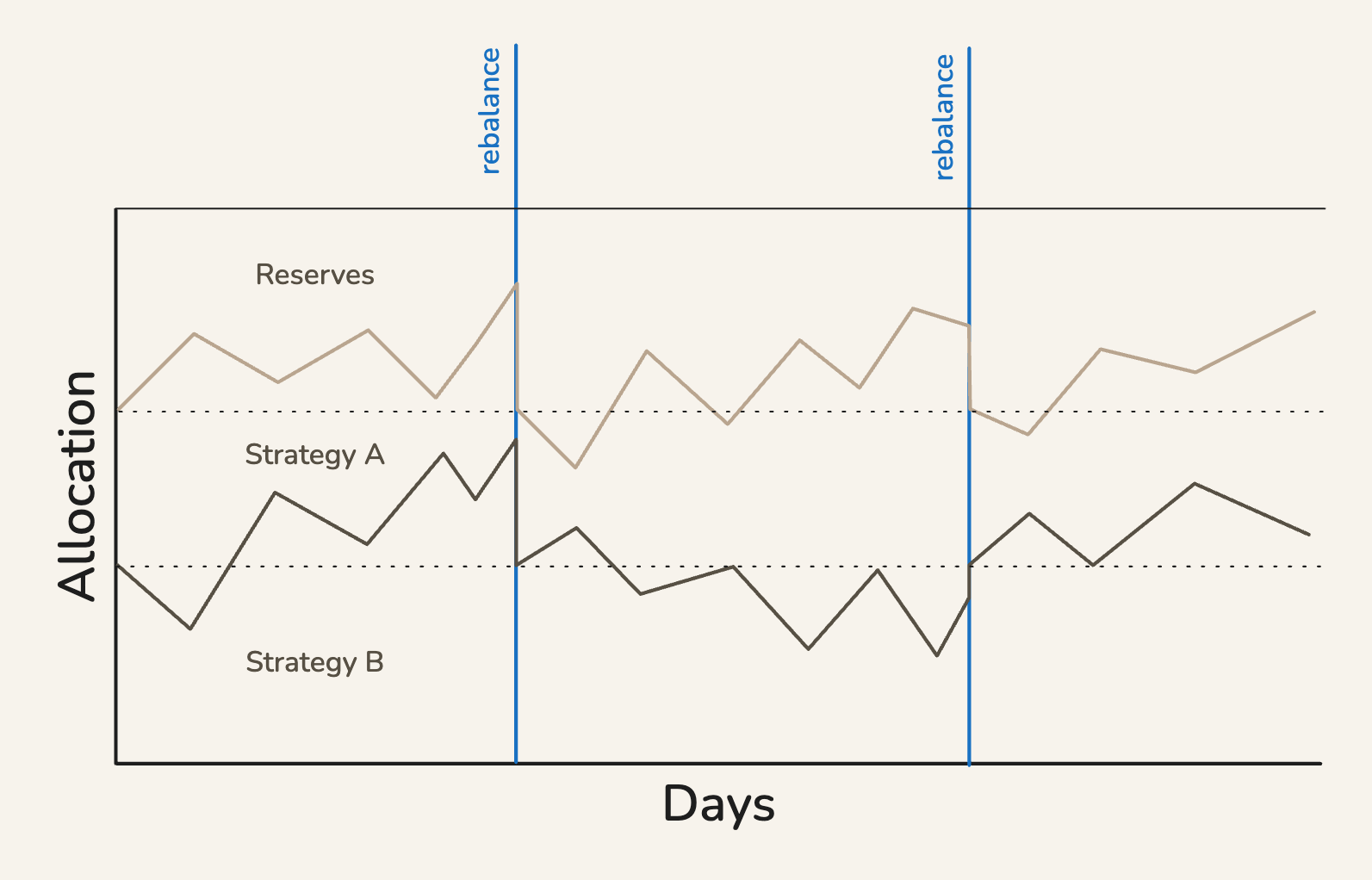

When a user deposits into an Earn vault, the vault mints ERC-4626 shares to the user’s wallet. A designated allocator then rebalances capital among the strategies that the curator has approved. Curators can define supply and withdrawal queues, which govern how deposits are deployed and how withdrawals are serviced, balancing performance with practical exit liquidity. Vaults can also maintain a small idle reserve, either in escrow or in a non-borrowable Euler Vault Kit (EVK) vault, so many withdrawals can be completed instantly without forcing the allocator to unwind positions at inopportune moments. All of these policies are applied and recorded on-chain.

Roles and accountability

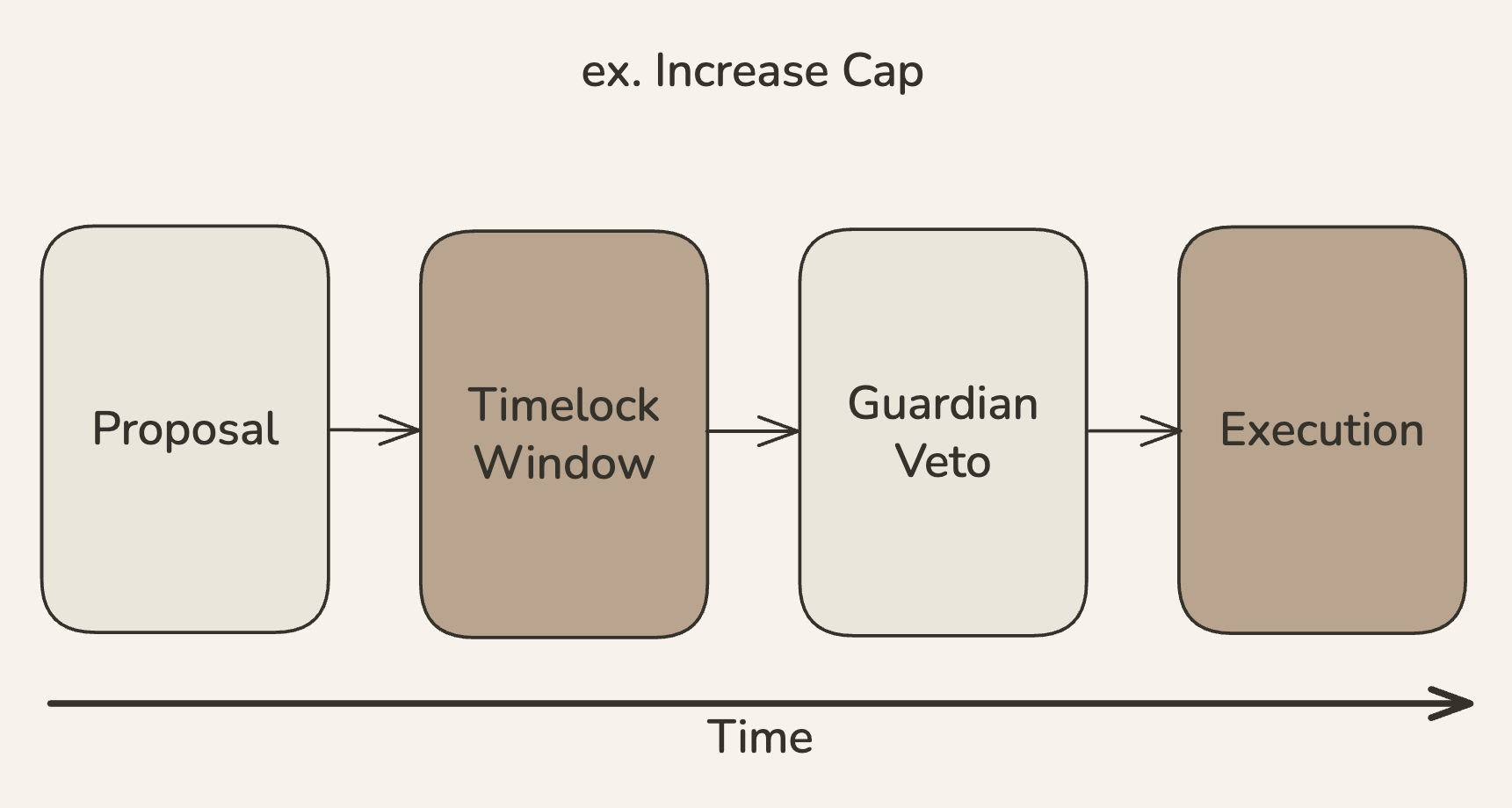

Each vault exposes a clear management schema, allowing users to see who is responsible for policy and execution. The Owner (typically a multisig) sets role addresses and high-level parameters. The Curator selects and approves the strategies the vault may use and can set per-strategy caps to avoid overexposure. The Allocator moves funds between strategies according to the vault’s policy, and the Guardian can veto pending critical actions as a last-resort safety brake. If a performance fee exists, a Fee receiver address is disclosed. These roles are published directly on the vault page to make operational control transparent.

| Owner | Curator | Allocator | Guardian | Fee Receiver | |

|---|---|---|---|---|---|

| Approve Strategy | ✓ | ✓ | – | – | – |

| Set cap ↑ | ✓ | ✓ | – | – | – |

| Set cap ↓ | ✓ | ✓ | ✓ | – | – |

| Move Funds | – | – | ✓ | – | – |

| Emergency Veto | – | – | – | ✓ | – |

| Receive Fees | – | – | – | – | ✓ |

Importantly, Earn vaults are immutable and permissionless, allowing for easy deployment. Sensitive changes such as increasing caps are subject to timelocks, while decreases can be instant, and the guardian’s veto adds a further layer of defence. Vault share tokens implement ERC20Votes, enabling communities or curators to coordinate governance using the same tokens that represent depositor claims. This combination of immutability, timelocks and explicit roles is designed to keep risk legible and bounded.

Safety rails, fees and liquidity

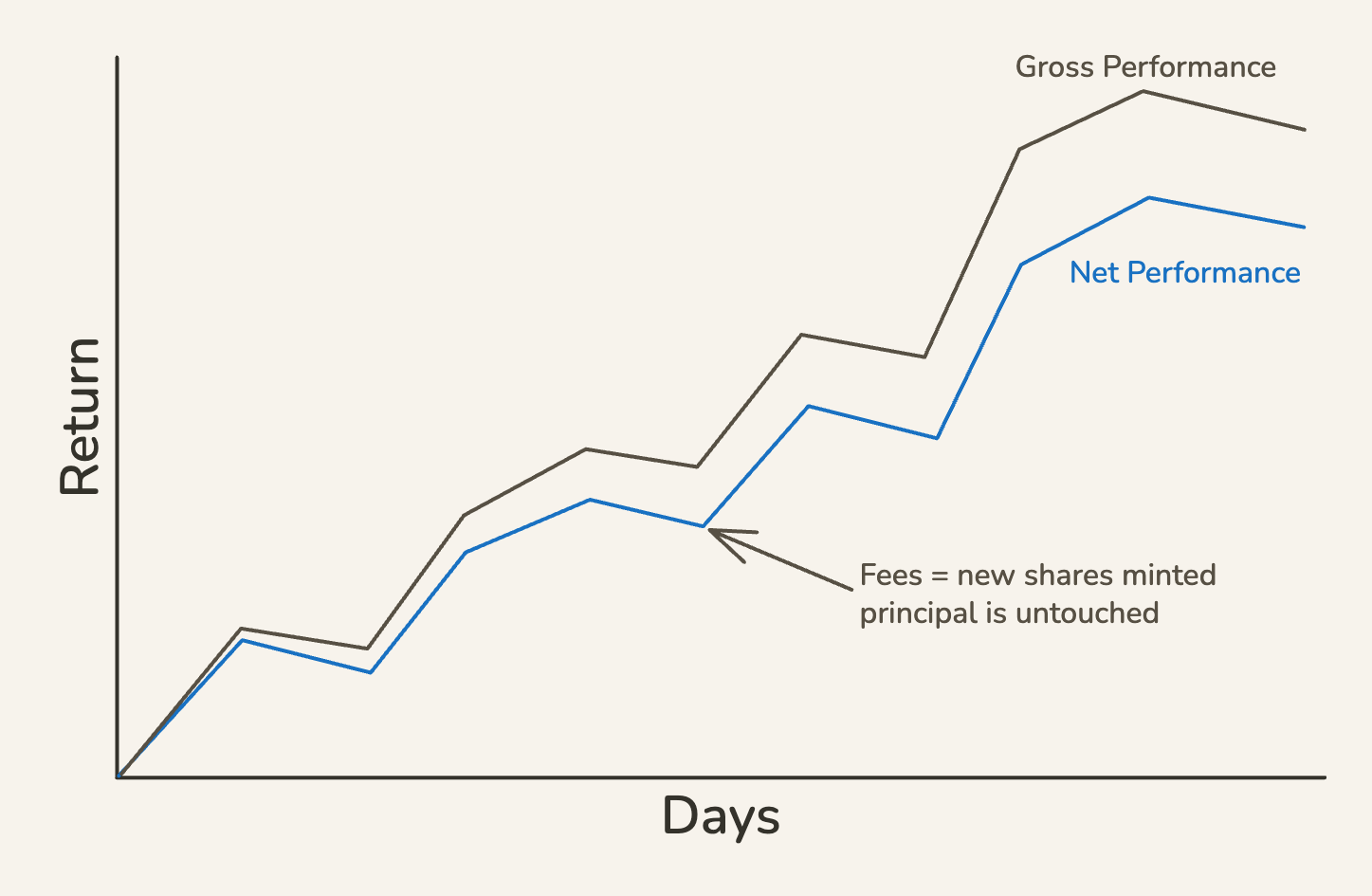

Risk in DeFi cannot be eliminated, but EulerEarn provides tools to contain and surface it. Per-strategy caps prevent any single allocation from dominating the vault. Curator-defined queues and optional idle reserves support predictable exit behaviour under normal conditions. When liquidity in the vault is temporarily insufficient, withdrawals remain permissionless; users can simply withdraw a smaller amount and retry as liquidity frees up. If a performance fee is set, it is charged only on positive yield as defined by the vault and is paid in additional vault shares to the fee receiver; the fee does not touch principal, aligning incentives with depositors. There is no protocol-level fee.

Who is this for?

EulerEarn is suitable for individuals seeking passive, single-asset yield without micromanagement, for DAOs and treasuries that want a transparent and governable allocation policy they can embed into broader treasury tooling, and for curators or allocators who want to publish their strategy policy in a permissionless, immutable framework. Because Earn is ERC-4626 throughout, it is readily composable with the rest of DeFi, including aggregators and structured-product wrappers.

Conclusion

EulerEarn turns the messy work of yield management into a simple deposit-and-hold experience, while preserving the transparency and self-custody that define DeFi. Users gain diversified strategy exposure through a single ERC-4626 position; curators express policy through caps, queues and rebalancing; and all decisions are visible, timelocked where necessary and subject to clear lines of responsibility. It is not a promise of risk-free returns, strategy underperformance, role misconfiguration and periods of lower immediate liquidity can all occur, but it is a deliberate design for making those trade-offs explicit and manageable on-chain. For many treasuries and individuals, that combination of simplicity, control and composability is exactly what passive yield should look like.

This article may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. The information, tools and material presented in this article are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.