dTRINITY: The Stablecoin That Pays You to Borrow

If you have spent any time in DeFi, you know how stablecoin lending usually works. You can deposit stablecoins to earn interest, or you can post collateral and borrow stablecoins if you need liquidity. What you also probably know is that borrowing stablecoins has been getting progressively more expensive. And when borrowing costs go up, activity slows down, meaning fewer trades, less liquidity, and lower returns for everyone involved.

dTRINITY flips this paradigm on its head. It is the first stablecoin protocol designed so that borrowers receive money back in the form of subsidies. In other words, it can pay you to borrow, and it does so in a way that is transparent, sustainable, and fully backed by real yield.

The Problem: Expensive Borrowing and Idle Capital

In traditional DeFi lending markets (like AAVE v3), lenders usually supply stablecoins and earn interest from the borrowers who use those funds. But when dealing with Yield-Bearing Stablecoins (YBS), like sUSDe or sUSDs, the borrower does not only pay the loan interest, they also have to cover the embedded yield owed to the asset’s holder. This makes borrowing these coins particularly expensive and unattractive.

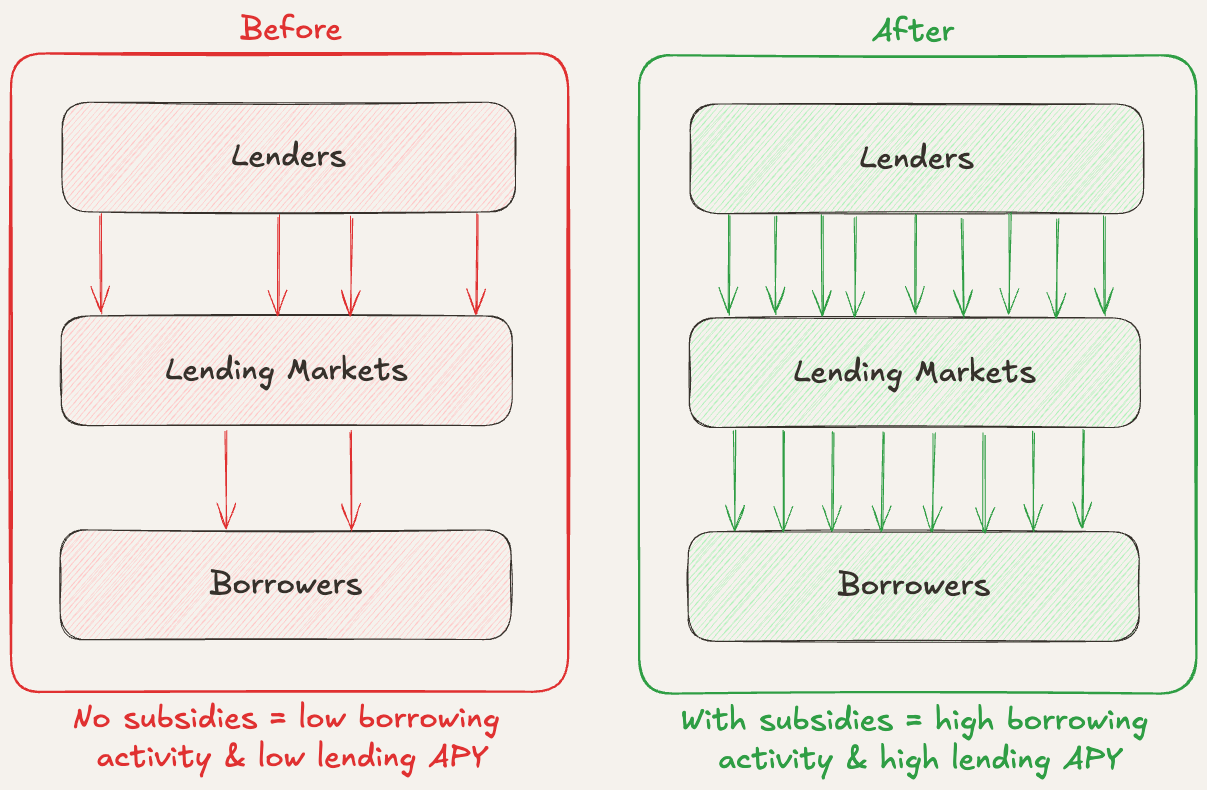

When borrowing costs are high, people borrow less. This means stablecoins (especially YBS) sit idle in lending markets, utilisation rates fall, and the whole system becomes less efficient. Some protocols attempt to address this issue by offering borrowers additional tokens as incentives, typically by printing more of their governance token. Over time, that inflates the supply and erodes the token’s value, which is hardly a sustainable fix.

The Solution: Subsidising Borrowers

dTRINITY changes the equation by redirecting the yield from the reserves of its own dUSD stablecoin as interest rebates. This means that when you borrow dUSD part of your interest cost is paid back to you from the protocol’s own yield.

When borrowing is cheaper, or even profitable in some cases, more people are willing to do it. Higher borrowing demand leads to higher utilisation rates, which means lenders’ returns also improve. This creates a feedback loop where both sides of the market benefit and the protocol’s total activity grows.

A simple way to picture it is to think of a mortgage subsidy. If the government covered part of your home loan interest every month, you might take a bigger loan or buy a better home. The same principle applies here, except instead of a government, the subsidy comes from the protocol’s reserve yield.

How It Works in Practice

It all starts with the dUSD reserve. Users can deposit approved stablecoins or YBS into the dTRINITY protocol and mint dUSD one-to-one. This dUSD can then be lent out to earn interest or borrowed against collateral. The key difference is that when you borrow dUSD, you receive an interest rebate from the yield generated by the reserves you just deposited.

This sets off what the protocol calls its “flywheel.” Subsidies make borrowing more attractive, which means more people borrow. More borrowing leads to higher utilisation of the lending pool, which pushes up interest rates for suppliers. Higher returns attract more deposits, which grow the reserve, which in turn generates more yield to fund the subsidies.

Where the Yield and Subsidies Come From

It can be unintuitive to imagine that a protocol pays you to borrow. This sounds almost too good to be true. But the subsidies are not magic money and they do not come from printing new tokens. They come from two main sources, all of which are verifiable on-chain.

First, a large portion of the reserve is held in yield-bearing stablecoins such as sUSDe and sfrxUSD. These assets automatically generate yield through their underlying strategies.

Second, dTRINITY provides liquidity in certain pools, particularly on Curve, where governance partners like Frax and Convex can direct reward emissions towards dUSD pairs. This boosts the returns from those pools.

The yield from these sources is collected into a rebate pool for borrowers, while lenders continue to earn interest in the usual way from the borrowing activity in the market.

Who Benefits and How

For lenders, the main advantage is higher returns than they would get from lending unsubsidised stablecoins such as USDC or USDT. Because borrowers are receiving rebates, they are willing to pay slightly more in base interest, which lifts supply APYs.

Borrowers enjoy lower net interest rates. In some cases, after the subsidy is applied, their net borrowing rate can turn negative, which means they are effectively being paid to borrow. For example, with subsidies of 5% APY, a nominal borrowing rate of 3% would result in a net borrowing rate of -2%. This means borrowers actually receive yield, instead of paying it. This can especially happen at lower utilisation rates, when a bigger proportion of the rebates flows to each individual borrower.

Liquidity providers also benefit. Thanks to the governance power of partners like Frax and Convex, Curve pools containing dUSD receive additional reward emissions (such as CRV or CVX), boosting LP yields and attracting more liquidity.

The Bigger Picture

The key to understanding dTRINITY is that it is not creating value from thin air. The rebates come from actual, external yield sources that can be audited on-chain at any time. By choosing to direct that yield to borrowers instead of keeping it entirely for lenders or the protocol, dTRINITY creates a more balanced, active market.

This balance matters because healthy lending markets need both sides: supply and demand in order to be strong. Over time, a subsidised borrowing model can mean more liquidity circulating in DeFi, higher utilisation of assets, and more competitive returns for everyone involved.

Conclusion

dTRINITY’s design is built on a simple but powerful idea: lending markets work best when both sides (lenders and borrowers) are strong. By redirecting real, on-chain yield from its reserve back to borrowers, the protocol lowers their costs, stimulates activity, and ultimately increases returns for everyone involved.

This is not about creating value from nothing, nor about inflating a governance token to keep the system running. It is about using existing, verifiable yield in a smarter way: one that keeps the market in balance and unlocks more activity.

You can see it for yourself by visiting the dTRINITY app and checking the live borrowing and lending rates. Compare how dUSD performs against USDC or USDT on platforms like Aave or Curve. And if you want to explore the deeper technical side, take a look at our detailed research articles here and here.

This article may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. The information, tools and material presented in this article are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.