$OM's Steep Descent: Anatomy of the April 2025 Market Crash

The cryptocurrency market recently witnessed another dramatic event, reminiscent of market shocks not seen on such a scale since the infamous LUNA implosion. Mantra ($OM), a token previously lauded for its Real World Asset (RWA) narrative and position among the top 25 cryptocurrencies by market cap, experienced a catastrophic price collapse.

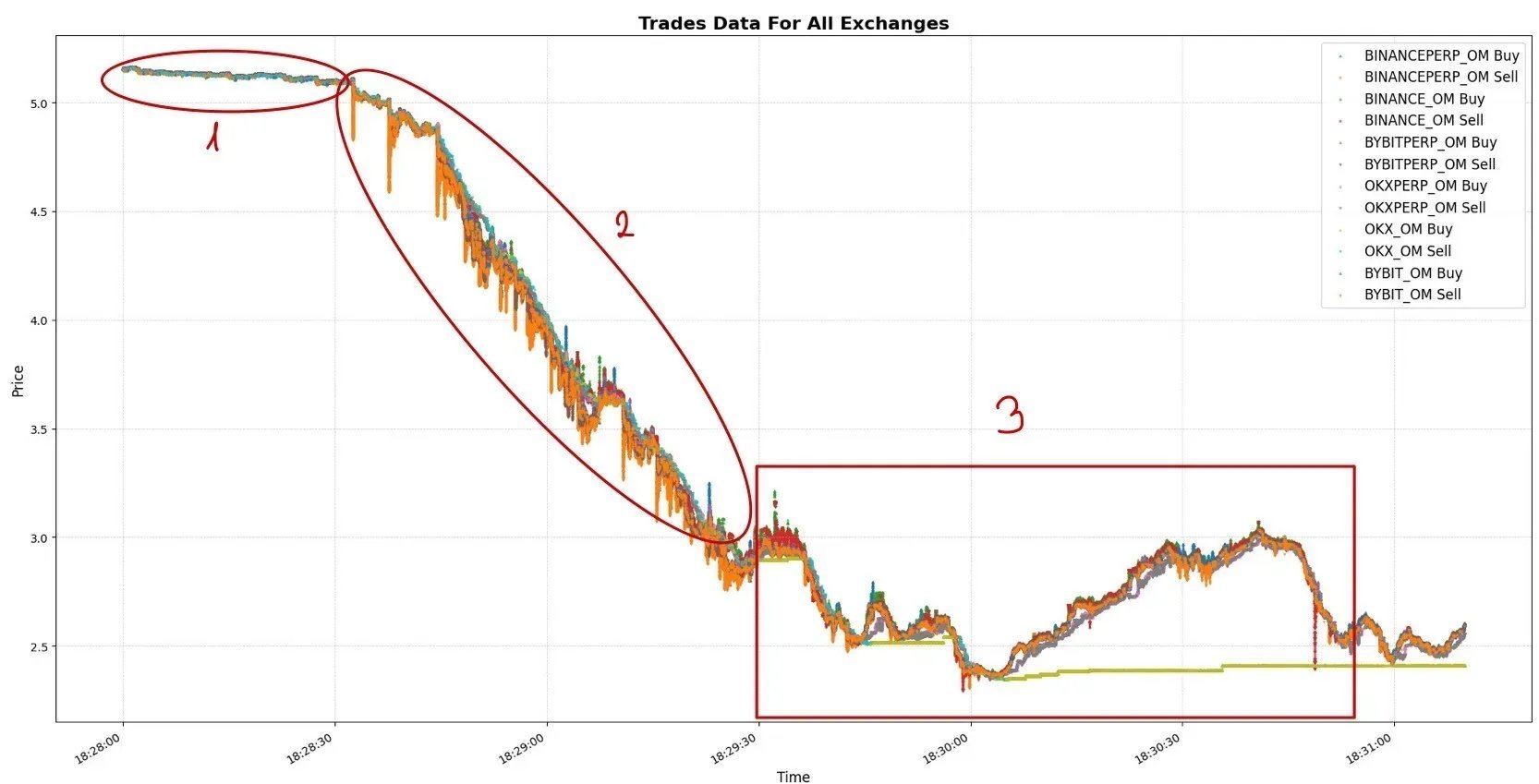

On the night of April 13th/14th, $OM's value plummeted by approximately 90% in less than 20 minutes, erasing billions in market capitalisation and leaving investors reeling. Initial reactions were chaotic, with speculation ranging from a malicious team rug pull to coordinated investor dumping. However, subsequent analyses and official statements suggest a more complex scenario rooted in market microstructure, leverage, and potentially forced liquidations, echoing systemic risks previously observed in other crypto market dislocations.

Price of $OM on the day of the incident

This article will look at the available data and communications surrounding the $OM crash, attempting to piece together the sequence of events, contributing factors, and the key actors involved.

The Initial Tremors

Market observers first raised alarms following the detection of significant $OM token movements, particularly deposits onto the OKX exchange preceding the major price drop. Analysis from sources like StarPlatinum highlighted transactions allegedly linked to MANTRA wallets totaling millions of dollars worth of $OM landing on OKX.

Suspicious large $OM transactions to OKX prior to the crash

These observations immediately fuelled speculation. Assertions circulated on social media implicating the Mantra team or major investors in selling activities. Laser Digital, a known Swiss-based strategic investor, was specifically mentioned in these early, often inaccurate, narratives. This prompted a swift denial from Laser Digital, who stated unequivocally on April 14th via X that they had "no involvement in the recent price collapse of $OM," labelling links to 'investor selling' as "factually incorrect and misleading." They further clarified that wallets being referenced depositing to OKX were not theirs and that their core $OM investment remained locked.

Deconstructing the Sell-Off

While initial blame was cast on spot market dumping (particularly on OKX), detailed market microstructure analysis, notably by researcher 'Itrd', painted a different picture of the event's mechanics, beginning around April 14th, 19:30 UTC.

Ltrd's breakdown suggests the sell-off was initiated and primarily driven by aggressive selling activity on Binance perpetual swaps (Perps) markets. Perpetual swaps allow traders to gain short exposure without holding the underlying asset, often utilising leverage, making them potent tools for impacting price, especially in markets with concentrated liquidity. The analysis indicated that significant selling pressure originated on Binance Perps, consistently leading price declines across other exchanges.

Analysis of the price action from ltrd

The large volume selling on OKX’s spot market, according to this analysis, appeared after the initial price drops instigated on Binance Perps. This OKX selling, characterised by large, aggressive marketable limit orders (dubbed the "OKX OM-Whale"), seemed less like an initiating event and more like a consequence, potentially forced selling or liquidation activity reacting to the crashing price. This contradicts the initial rumours that OKX was the primary source of the dump. The analysis highlights how cumulative volume delta (CVD) could be misleading in such scenarios, appearing positive on OKX spot due to large single limit sell orders being filled by many smaller buy orders (often arbitrageurs), rather than indicating broad buying pressure.

The Collateral Chain Reaction

Understanding why such aggressive selling occurred requires exploring potential underlying triggers. A prominent theory, detailed by Itrd and fueled by rumors noted in other analyses (arndxt, StarPlatinum), revolves around the use of $OM tokens as collateral for USDT loans.

The hypothetical scenario unfolds as follows:

Entities borrow USDT, using their $OM holdings as collateral.

They deposit this USDT onto an exchange with deep derivatives liquidity (like Binance).

They aggressively short $OM perpetual swaps, intentionally crashing the price with large orders.

The price crash triggers margin calls and liquidations on the $OM-collateralised loans (potentially their own or those of others caught in the spiral).

The forced selling on spot markets (like the "OKX OM-Whale") could represent these liquidations occurring.

This theory gains credence from on-chain analysis presented by Itrd, linking a specific Ethereum wallet (0xebb8...77d2), which began staking $OM 448 days prior and notably started claiming rewards just six days before the crash, through several hops to a wallet labeled as an OKX Deposit address (0xB37D...f26A). While not definitive proof of intent or the exact loan mechanism, this connection strongly suggests the entity aggressively selling on OKX spot had deep, long-term ties to $OM and potentially a vested interest that necessitated a rapid, forced exit when the market turned.

Mantra's Response

Facing intense community pressure, the MANTRA team, including CEO JP Mullin, issued statements and a formal post-mortem. Key points included:

Strong Denial of Team Selling: Mantra explicitly stated "there were no sales by the MANTRA team during this period of market distress." They emphasized that team and advisor allocations on the Mainnet remained locked.

Token Supply Clarification: They differentiated between legacy ERC-20 OM (launched Aug 2020, ~99.995% in public circulation, outside team control) and Mainnet OM (launched Oct 2024, limited circulation, team/advisor tokens locked). The incident primarily involved the widely distributed ERC-20 tokens.

Acknowledgment of Forced Liquidations: Their report confirms awareness of "significant amounts of OM tokens moved onto exchanges for use as collateral" and "forced OM position closures during a period characterized by reduced market activity."

Commitment to Transparency: Promises included a post-mortem report, an $OM token buyback and burn program, and a live dashboard for tracking tokenomics buckets. CEO JP Mullin later announced he would burn his personal team allocation (150M OM) as a sign of commitment, with plans for an additional 150M burn via ecosystem partners.

These communications aimed to counter rug pull accusations and attribute the crash to external market forces and leveraged positions held by entities outside the core team.

Conclusion

The rapid collapse of $OM's price in April 2025 was likely not a simple team-orchestrated rug pull, based on available evidence and official denials. Instead, it appears to have been a complex market event driven by aggressive selling on derivatives markets, potentially linked to the unwinding of leveraged positions collateralised by $OM tokens. Forced liquidations on spot exchanges like OKX seem to have been a consequence, rather than the cause, of the initial downward pressure.

While MANTRA's commitments to buybacks, burns, and increased transparency are steps toward rebuilding trust, from an analytical perspective, the official explanations can be viewed as unsatisfactory. A 90% price collapse in under 20 minutes is exceptionally drastic, even by volatile cryptocurrency standards. Attributing it solely to generalized "forced liquidations" without further clarification feels incomplete. Crucially, definitive identification of the party (or parties) initiating the aggressive selling on Binance Perps and the entity behind the large, forced liquidations on OKX remains elusive.

This lack of clarity on the key actors prevents a truly complete post-mortem and leaves lingering questions about potential coordination or specific vulnerabilities exploited. Without knowing who was involved and their precise mechanisms, assurances about preventing recurrence lack concrete backing. The incident serves as a stark reminder of the inherent risks in volatile crypto assets, the amplified danger posed by leverage, and the critical need for investor due diligence beyond surface-level narratives and team communications. Addressing the systemic vulnerabilities related to leverage, collateralization, and fragmented liquidity transparently will be crucial for the maturation and stability of digital asset markets.

This article may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 512m AG or its affiliates to any registration or licensing requirement within such jurisdiction. The information, tools and material presented in this article are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments.